Choosing a no-code builder for your financial app: A decision-maker's guide

Choosing a no-code builder for your financial app: A decision-maker's guide

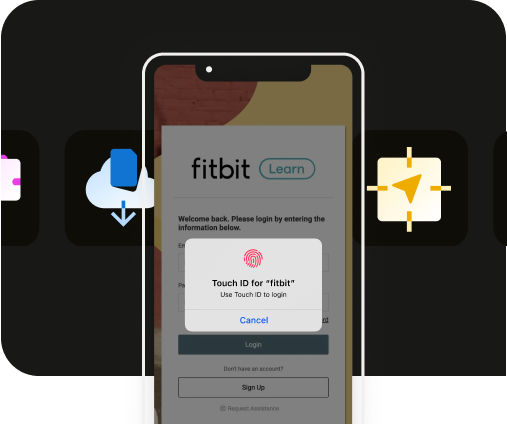

No-code and low-code app building platforms enable businesses from all industries, like McKesson, FitBit, and Conrad Siegel to turn their existing ideas into full-feature mobile apps with no prior development experience necessary (and without having to outsource developers to get the job done).

This is especially relevant for PMs working in the asset management, banking, insurance, and other financial industries who have 'build an app' on their task list. Ultimately, finance-first businesses are looking for easier ways to provide their customers with a multitude of services. They:

- Enable businesses to provide instant access to credit card statements

- Facilitate quick and secure money transfers

- Offer real-time updates on account balances

- Make loan applications easy

- Provide tools for budgeting and expense tracking

- Offer investment and retirement planning tools

- Use user management controls

- Offer features for bill payments and reminders

All these functionalities aim to make financial management easier and more convenient for their customers.

In today's article, we’ll delve into what a no-code mobile app builder is, the types of plugins that enhance finance apps, and end with some tips for choosing a suitable platform to build finance apps tailored to your needs.

Key takeaways

- No-code app builders provide finance businesses with the ability to create finance apps quickly and efficiently, on time and on budget, without requiring Android or iOS coding knowledge.

- When selecting a no code platform for finance apps, it's important to consider factors such as usability, adaptability, and integration capabilities in order to ensure that your finance-related objectives are met, and that you can manage and maintain your finance app in the long-run.

Understanding no-code finance app builders

No-code mobile apps have fundamentally transformed the manner in which financial apps are created and managed. They provide non-technical project managers with the ability to design bespoke financial applications, eliminating the necessity for writing code, outsourcing app development, and hiring full development teams to get the app done.

These advanced platforms significantly expedite the financial application creation process, rendering it more cost-efficient compared to traditional programming methodologies.

To fully comprehend the capabilities and advantages of no-code financial app builders, it is essential to distinguish them from low-code platforms. While both strive to simplify the process of software application development, no-code platforms prioritize ease-of-use for non-developers, whereas low-code platforms are better suited for developers with some coding proficiency. Given these distinctions, it is crucial to meticulously examine the unique features and benefits provided by no-code financial app builders.

What is a no-code finance app builder?

No-code app builders are platforms designed to empower non-technical users in the finance industry (and beyond) to develop web and mobile apps in a simpler way than traditional app-building approaches. They come equipped with features such as native functionality, advanced logic, straightforward publication methods, and instant preview technology that give financial professionals an opportunity to create sophisticated apps without coding skills.

Popular no-code app building platforms like the Median App Studio offer editing and branding tools. This means anyone, even those in the finance sector with no technical background, can construct their own finance-related apps quickly and effortlessly, and ultimately put banking at their customers' fingertips.

What's the benefit of a no-code app builder for a financial business?

They've become a popular solution for businesses looking to save time and resources for app development projects. These platforms provide users with powerful mobile apps with user-friendly in-browser interfaces which require no coding knowledge.

This convenience allows companies to bring their ideas quickly into the market with rapid development cycles. Leadership can then delegate non-technical tasks away from developers who can then focus on more complex projects, all without needing to write any additional custom iOS or Android app code themselves.

As a result, these tools give teams both flexibility in resource management and an efficient way of creating apps.

No-code tools for developing hybrid apps

No-code tools can be used to create different types of mobile apps, but today we'll focus on web+native hybrid apps.

Hybrid apps

No-code app builders can be used to instantly build and customize full-feature hybrid apps. Hybrid apps combine the best elements of both native and native mobile apps and web applications, offering a consistent experience across multiple devices. These no-code app builders provide businesses with many benefits, including:

- Saving time and resources through their visual interface that requires minimal coding knowledge

- Providing enhanced security by leveraging the advantages of each type of application in one platform

- Increasing engagement with the help of plugins that personalize the mobile experience

So, choosing the right app builder means more than just faster development – it offers comprehensive functionality for companies looking to create high quality experiences across devices.

Industry spotlight: No-code financial apps

Using no-code app builders like the Median.co App Studio, you can create financial apps customers that help them to track budgets, manage investments, and plan finances (plus many other interactions they have with your business). The convenience and ease of use is beneficial for both individuals and businesses alike.

When selecting an appropriate platform to build a no-code financial app, there are several critical considerations that must be made:

- Features of the builder: The platform should offer a comprehensive set of features that cater to the specific requirements of a financial app, such as transaction processing, account management, and financial reporting.

- Integration capabilities: The platform should be able to seamlessly integrate with third-party services which are crucial for financial apps, such as payment gateways, financial institutions, and credit reporting agencies.

- Scalability: The platform should be able to handle an increasing number of users and transactions as your financial app grows in popularity.

- Security: Given the sensitive nature of financial data, the platform must have robust security measures in place to protect user data. This includes encryption, secure user authentication, and regular security updates.

- Compliance: The platform should have features that enable compliance with financial regulations, such as data privacy laws and anti-money laundering regulations.

- Support and maintenance: The platform should offer ongoing support services to ensure your app is regularly updated.

- Cost: The cost of using the platform should be within your budget, taking into account both upfront costs and ongoing fees for maintenance and upgrades.

By taking into account the requirements listed above while choosing your desired mobile app development and framework – users can develop powerful and customizable financial, banking, and/or asset management apps without needing any technical coding expertise or heavy-lifting....

Trusting Median.co for building financial apps

As a leading no-code app platform, Median.co has been a trusted partner for many financial institutions for over a decade. The platform's robust features, ease of use, and long-term support make it an excellent choice for building full-feature financial apps.

One of the key reasons why financial institutions trust Median.co is its comprehensive set of features designed specifically for the finance industry. From transaction processing and account management to financial reporting and secure data handling, Median.co's platform and plugin library offers everything a financial institution needs to create a powerful, secure, and trustworthy app.

The platform is designed to be user-friendly, even for those without a technical background. Its intuitive interface and drag-and-drop functionality allow users to create and customize their app with ease. This not only speeds up the app development process but also reduces the need for extensive coding knowledge.

But what sets Median.co apart from other no-code platforms is its commitment to support the longevity of the apps built on its platform. Median.co provides ongoing support and regular updates to ensure that an app stays up-to-date with the latest technologies and security measures. This is crucial in the ever-evolving world of finance, where staying ahead of the curve (and iOS and Android updates and new versions) is key to an app's sustainability and success.

A case in point is Conrad Siegel, an asset management firm that leveraged Median.co to build their app. With Median.co's platform, Conrad Siegel was able to create a robust, secure, and user-friendly app that not only met their immediate needs, but also supported their long-term growth.

In summary, Median.co's no-code app platform offers the features, usability, and long-term support that financial institutions need to build and maintain a successful app. With Median.co, you can trust that your app will be built to last and will continue to serve your customers effectively for years to come.

Plugins for no-code finance apps

One of the most compelling aspects of no-code platforms is their ability to leverage plugins. These plugins can extend the functionality of your finance or banking app, integrating additional features and services that enhance both the app's capabilities and the user experience.

For instance, you could add a plugin for secure transactions, allowing your app to handle payments and transfers. Or, you might integrate a plugin for financial reporting, enabling users to view their account balances and transaction history directly within your app.

You can view a full library of plugins for finance apps here.

Financial app plugins: 5 popular examples

No-code platforms can enhance an app’s features and make development easier by providing plugins that connect the software with external services.

Some offer a huge selection of plugins and app add-ons like QR/Barcode scanning, Social Login, and Push Notifications to name just a few. They collaborate with several popular third parties such as OneSignal, Meta App Events, Twilio, Sendbird, Salesforce Marketing Cloud or Google Firebase in order to ensure the app you build with them can sport as many third-party plugins and features as possible.

Using plugin integrations through no-code apps gives users access to engaging content and tools for improved customization, all while streamlining the app building process so it keeps up with modern innovations in technology marketspace efficiently.

Let's look at five popular plugins that financial companies typically add to their apps. Generally, these aid customers in a seamless experience, while also ensuring their data and accounts are secure and protected.

Enterprise Security plugin: A safe bet for finance apps

One of the standout features of the Median.co App Studio is its Enterprise Security plugin. This powerful tool is designed to enhance the security of the finance apps built on the platform, which is a crucial aspect when dealing with sensitive financial data.

The Enterprise Security plugin offers a host of features that contribute to the secure functioning of finance apps. These include screenshot blocking for Android, Network Security policy configuration, copy and paste functionality blocking, and App Transport Security (ATS) enforcement to prevent unencrypted requests. By integrating these features into your finance app, you can ensure that your users' data is protected against potential security breaches.

In addition to its security features, the Enterprise Security plugin also offers benefits in terms of user experience. By integrating advanced security measures into your app, you can provide your users with peace of mind, knowing that their financial data is safe and secure. This can lead to increased user trust and engagement, ultimately benefiting your app's success.

Learn more about enterprise security plugins >>

JailBreak/Root Detection plugin: Enhancing security for finance mobile apps

An important offering from Median.co's plugins is the JailBreak/Root Detection tool. This feature is particularly valuable for finance apps, where security is of utmost significance.

The JailBreak/Root Detection tool is designed to boost the security of finance apps by identifying if a user's device is jailbroken or rooted. These malicious practices give users higher access privileges and allow them to bypass app restrictions, which means they can get to (potentially) sensitive data and compromise it.

Jailbreaks can potentially expose apps and users to security threats, as they override certain restrictions set by the device manufacturer. This can leave the device susceptible to malware or other serious activities, posing a significant risk for finance apps that handle sensitive user data.

If such a device is detected, the app can take suitable action, like restricting access to the app or limiting its functionality. This helps safeguard the app and its users from potential security threats.

Learn more about JailBreak/Root Detection plugins >>

Authentication plugin: Perfect for securing financial apps

Another essential plugin to consider is the Auth0 plugin. This feature is crucial for financial apps operating on iOS devices, where user authentication is a fundamental security measure.

The Auth0 plugin enables developers to incorporate secure user authentication systems into their financial apps. It allows users to register, log in, and manage their accounts using their email addresses or social media accounts. This feature ensures that only authorized users can access sensitive financial data, enhancing the security of the app.

Moreover, the plugin supports multi-factor authentication, adding an extra layer of protection. With this feature, users are required to verify their identity through more than one method, such as a password and a unique code sent to their mobile number.

The Auth0 plugin also facilitates password recovery. In case users forget their passwords, they can easily reset them via their email addresses, ensuring they can regain access to their accounts promptly.

Furthermore, the plugin allows for user data management. It enables developers to store, retrieve, and manage user data securely. This feature is particularly useful for personalizing the user experience, as it allows the app to remember user preferences and settings.

Learn more about the Auth plugin >>

Document Scanner plugin: A game changer for financial apps

One of the powerful plugins that Median.co offers is the Document Scanner plugin. This tool is particularly beneficial for financial apps, where document scanning and processing are often required.

The Document Scanner plugin allows users to capture high-quality images of documents using their device's camera. It can automatically detect the edges of the document, correct the perspective, and enhance the image quality. This makes it easy for users to scan important documents like bank statements, invoices, receipts, and contracts directly within an app.

For financial apps, this feature can significantly improve the user experience. It saves users the hassle of manually uploading or entering data from physical documents that are still fundamental in many transactional processes (like buying a house, applying for a line of credit, and more). Instead, they can simply scan the document using their device's camera and the app will process the information automatically.

Learn more about document scanner plugins >>

Native Datastore plugin: Enhancing data management for financial app users

Another standout plugin for financial apps? The Native Datastore plugin. This plugin is particularly beneficial for financial applications, where efficient data management is crucial.

The Native Datastore plugin allows financial apps to store and retrieve data directly on the user's device. This means that users can access their financial information even when they are offline, providing a seamless user experience regardless of internet connectivity.

For financial apps, this feature can significantly enhance the user experience. Users can access crucial financial information such as account balances, transaction history, and investment performance at any time, regardless of their internet connection. This is particularly useful for users who travel frequently or live in areas with unreliable internet access.

In addition to improving the user experience, the Native Datastore plugin can also improve the performance of financial apps. By storing data locally on the user's device, the app can retrieve this information more quickly, resulting in faster load times and a smoother user experience.

Learn more about native datastore plugins >>

Tips for choosing the right no-code builder for web apps

When choosing the most suitable no-code app builder for your finance app, several factors must be considered. These include usability, adaptability, design autonomy, and cost-effectiveness.

It's crucial to evaluate the cost, both in terms of upfront fees and potential additional charges. Check if the platform offers a free plan.

Assess the scalability of these no-code development platforms, as they should be capable of handling an increasing number of users. The level of customer support and updates offered to ensure quality performance over time is also a critical factor.

Integration capabilities are another key aspect to consider. Your chosen platform should be able to integrate with essential financial tools and services.

By conducting thorough research on all potential options and comparing their features against your finance app objectives, you can find the right no-code builder. This can transform your finance app idea into reality while optimizing the costs involved in the development process.

Choose a trusted app development platform and service provider that works for your business

When selecting a reliable platform and service provider for app development, it's important to take a few steps to ensure your final financial product will be high-quality, easy to maintain, and worth the spend:

- Consider the features offered by the platform.

- Look at its integration capabilities with other necessary services.

- Evaluate the scalability levels and security protocols it provides.

- Check if it offers cross-platform/mobile support.

- Look into the company’s assurance on quality production, ability to collaborate well, and its ability to offer post-service support if needed.

By opting for an appropriate no-code app development method that satisfies all business objectives supplemented by required integrations, you can help guarantee successful launch of progressive web apps whilst also providing users a seamless journey throughout their experience with fully functional apps.

Summary

No-code app builders have completely changed the game in the realm of financial app creation, management, and deployment. They have paved the way for anyone to transform their financial app concepts into tangible, functional applications, regardless of their coding proficiency.

When choosing a no-code platform for your financial app, it's crucial to consider factors like cost, scalability, and maintenance. With the right no-code builder, you can significantly reduce the time and effort spent on developing financial apps, thereby enhancing profitability.

It's also important to understand the differences between low-code and no-code platforms, as well as basic app makers, to ensure you select the most suitable tool for your financial app development needs.

Frequently Asked Questions

What is a no-code app builder for financial apps?

A no-code app builder for financial apps is a platform that allows users to create finance-focused applications without the need for traditional coding. These platforms offer a user-friendly interface where users can design their finance app and define its functionality with a drag-and-drop system.

Who can use no-code app builders for financial apps?

No-code app builders for financial apps are designed to be accessible to everyone, regardless of their technical background. This means that financial advisors, accountants, finance managers, and other professionals in the finance industry can use these tools to create apps without needing to learn how to code.

Are no-code app builders for financial apps secure?

Security is a priority for most no-code platforms, especially when dealing with financial data. These platforms typically have built-in measures to protect user data. However, it's important for users to follow best practices for data security, like using strong passwords and regularly updating the app.

How customizable are no-code financial apps?

While no-code app builders may not offer the same level of customization as custom-coded apps, they do provide a wide range of design and functionality options. Users can choose from various templates, color schemes, and features to create a finance app that aligns with their brand and meets their specific needs.

Can I monetize financial apps built with a no-code app builder?

Yes, financial apps built with no-code platforms can be monetized in several ways, including premium features, subscription models, and ad revenue. The specific monetization options available may depend on the app builder you opt for.

to top

.webp)